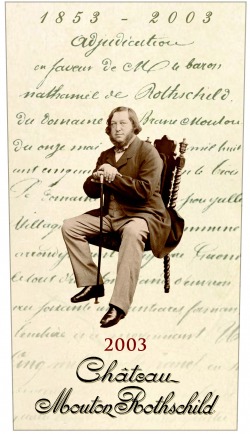

Mouton Rothschild is of course a legend amongst clarets and is perhaps our very favourite of Bordeaux’s first growth wines. Sadly, with the legend comes a price tag to match and unless you’re the Duke of Westminster or Roman Abramovich, it’s not for everyday drinking. With our view that second wines rather than the grand vins can offer tremendous value without losing too much in the process, this week, after some waiting, we finally took delivery of a half case of Le Petit Mouton, the second wine of Mouton Rothschild. On this occasion though, we were somewhat underwhelmed.

In the case of Le Petit Mouton, the total output is, according to Parker’s Bordeaux: A Comprehensive Guide just 10% of total production at the estate. With so little to go around, it’s actually quite hard to get your hands on and when you do, limited supply and the Mouton name means it’s not really that cheap. We sourced 2004 Le Petit Mouton for around £70 per bottle (so still not everyday drinking wine) though for the grand vin itself, you’d be looking closer to £250. Definitely a saving then but can it compare?

While second wines drink younger than their grand vin brothers, it still seems a little early to drink the 2004 Petit Mouton and the tannins were present though not harsh with two more years of cellaring perhaps needed. The chateau’s own tasting notes describe it as follows:

The wine, a deep and concentrated ruby red, has a nicely open, expansive and varied nose on which jammy cherry fruit, liquorice and spice mingle with the toast and vanilla of elegant oak.

Lush on the palate, it combines a stylish structure of well-rounded tannins with fresh, juicy red fruit, vine peach and caramel and a discreet but refined and agreeable touch of pepper in a rich and harmonious balance.

In the case of Le Petit Mouton, the total output is, according to Parker’s Bordeaux: A Comprehensive Guide just 10% of total production at the estate. With so little to go around, it’s actually quite hard to get your hands on and when you do, limited supply and the Mouton name means it’s not really that cheap. We sourced 2004 Le Petit Mouton for around £70 per bottle (so still not everyday drinking wine) though for the grand vin itself, you’d be looking closer to £250. Definitely a saving then but can it compare?

While second wines drink younger than their grand vin brothers, it still seems a little early to drink the 2004 Petit Mouton and the tannins were present though not harsh with two more years of cellaring perhaps needed. The chateau’s own tasting notes describe it as follows:

The wine, a deep and concentrated ruby red, has a nicely open, expansive and varied nose on which jammy cherry fruit, liquorice and spice mingle with the toast and vanilla of elegant oak.

Lush on the palate, it combines a stylish structure of well-rounded tannins with fresh, juicy red fruit, vine peach and caramel and a discreet but refined and agreeable touch of pepper in a rich and harmonious balance.

In our view, the nose was indeed big, the fruit flavours bold and there was a nice balance to the wine but ultimately there was no wow factor and little by way of complexity. Each time we drink the Mouton grand vin, we literally feel in awe of the wine and know that we are in the presence of greatness. We felt though with Le Petit Mouton, if served at a dinner party for example, few guests would be commenting on it – it’s a nice but, at the end of the day, unremarkable claret.

We’re still a huge fan of second wines but something like Chateau Palmer’s Alter Ego (2001) can be obtained for under £40 a bottle and drinks just as well in our view. However, some of the best value we feel is in the grand vin of the lower rated growths such as second growth Pichon-Longueville Baron. A Pauillac wine like Mouton, situated adjacent to Latour, we recently acquired at auction the 1997 Pichon Baron at just £43 per bottle. Scoring 87-90 Parker points, we loved this wine; the bottle age is now coming through wonderfully on both the colour and the taste and the balance is just lovely. Accordingly, the '97 is an easy drinking medium weight wine with a satisfying finish that we love to revisit again and again. Each and every time, we would choose the Pichon Baron over Le Petit Mouton and for that we get up to a decade or more of bottle age and £30 spare change in our pocket. We love the Mouton Rothschild grand vin (of course) and we’ll certainly be happy to finish up Le Petit Mouton we now have in store but we wont be refreshing our order when we run dry.

We’re still a huge fan of second wines but something like Chateau Palmer’s Alter Ego (2001) can be obtained for under £40 a bottle and drinks just as well in our view. However, some of the best value we feel is in the grand vin of the lower rated growths such as second growth Pichon-Longueville Baron. A Pauillac wine like Mouton, situated adjacent to Latour, we recently acquired at auction the 1997 Pichon Baron at just £43 per bottle. Scoring 87-90 Parker points, we loved this wine; the bottle age is now coming through wonderfully on both the colour and the taste and the balance is just lovely. Accordingly, the '97 is an easy drinking medium weight wine with a satisfying finish that we love to revisit again and again. Each and every time, we would choose the Pichon Baron over Le Petit Mouton and for that we get up to a decade or more of bottle age and £30 spare change in our pocket. We love the Mouton Rothschild grand vin (of course) and we’ll certainly be happy to finish up Le Petit Mouton we now have in store but we wont be refreshing our order when we run dry.

RSS Feed

RSS Feed